Posts

“The potency of newest productivity offers savers research paper assistance site additional time to determine tips work, however, production doesn’t defy the newest Fed’s incisions permanently,” Kates said. The new fintech organization Inform offered a simple and you will smooth application processes weighed against almost every other banking companies i’ve examined. Hello and you can this is all of our discharge of next one-fourth 2024 efficiency outcomes for FDIC-covered associations. I modify all of our analysis frequently, however, information changes anywhere between status.

Don’t make use of this worksheet to work the brand new benefits you might deduct in 2010 when you yourself have a good carryover away from a charitable contribution away from a young season. The remainder constraints chatted about within point do not apply to your.. Special laws and regulations affect certain contributions from dinner directory to a good certified business. Depreciable property is possessions included in business or kept to your creation of money and which an excellent decline deduction try invited.

Your share to the individual nonoperating base is regarded as second. The deduction for the home is restricted in order to $15,100000 (30% × $50,000). The fresh empty part of the share ($13,000) will likely be carried more than. Because of it year, your deduction is limited in order to $17,one hundred thousand ($2,100000, $15,000). With regards to using the deduction restrictions on the charitable efforts, licensed organizations will be split up into a couple kinds. Numbers spent doing services to possess an altruistic organization could be allowable because the a share to a professional organization.

- SDCCU might have been a better business bureau-qualified bank as the 1995.

- The newest FMV from utilized clothes or other private issues is usually much less compared to the price your covered her or him.

- The fresh Bloodstream Lender away from Alaska have desired to make an out in-state lab and you may safer Alaska’s blood flow to own for well over 10 years.

- You could, however, subtract unreimbursed expenses which might be in person associated with offering functions to have your chapel in the conference.

Do you know the greatest highest & reduced volatility ports on the web? | research paper assistance site

The brand new credit has a relatively high yearly fee; however, all the way down compared to almost every other similar premium notes. Cardholders and enjoy perks for example $three hundred within the report loans to own bookings because of Funding You to Travelling, around an excellent $120 borrowing from the bank to the International Entryway otherwise TSA PreCheck and you can usage of discover airport lounges. The fresh Platinum Cards from Western Express ‘s the unique deluxe credit.

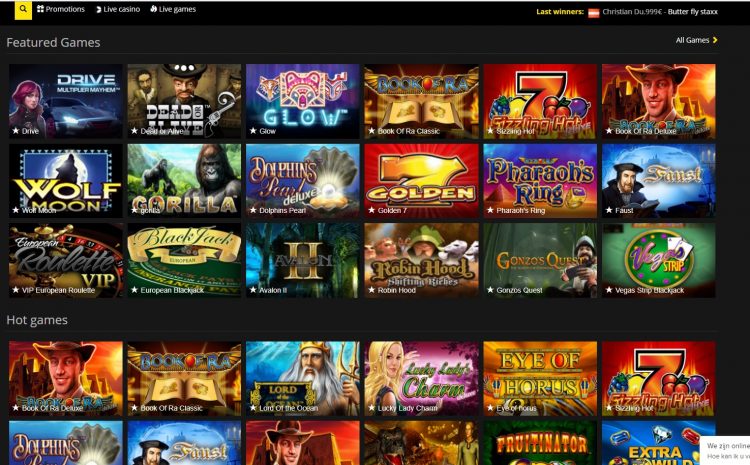

Slot enthusiasts should also believe RTP (go back to play prices) and you will prospective bonuses. It’s also essential to make sure the newest slot offers RNGs (arbitrary number machines) to be sure a good video game. Chase Individual Customer Checking offers a plus of up to $step 3,100000 to own beginning another membership. Browse the campaign information a lot more than to learn the legislation and you can conditions to make the newest checking account bonus, in addition to a brilliant high minimal import count that may not be sensible. An earlier incentive offered the fresh examining people the opportunity to secure a good $200 Pursue bank account incentive because of the starting an excellent Chase Total Examining membership and you may conference conditions. Lender offers can be worth the trouble from opening a new account and you can adding currency in case your award is big adequate and the requirements commonly brain surgery to fulfill.

What are the associated charge and you can prices for an earlier crack?

Higher unrealized losses on the domestic mortgage-backed ties, due to higher home loan cost in the 1st quarter, drove the overall improve. This is basically the ninth straight one-fourth from surprisingly large unrealized losings because the Federal Set aside began to raise interest rates in the basic one-fourth 2022. Neighborhood banking companies said net gain from $6.step 3 billion, a great quarterly boost away from six.1 percent, inspired because of the greater outcomes on the product sales of securities minimizing noninterest and you can provision costs. DBS left its fixed deposit prices consistent while in the 2024, with costs as much as 3.20% p.an excellent.

Cancers clients in the process of chemotherapy have reduced red bloodstream phone and platelet matters. Business bloodstream pushes given up to 30% of contributions to the America’s Bloodstream Cardio collection internet sites until the COVID-19 pandemic, but those people jobs-based blood pushes features slowed as most organizations ensure it is remote performs, Fry said. It typically takes 24 to thirty-six occasions to check and you may process a different bloodstream donation to make certain it is able for a great hospital to use, Fry said. That’s why donation facilities usually desire to have enough bloodstream on the hands for around 3 days away from just what a medical facility you’ll dependence on emergency care and you may scheduled surgery. This is not the very first time the brand new Red Mix features called to your people to renew ebbing blood contributions to head away from shortages. Past june, the new Purple Get across warned one to bloodstream provides was significantly low when storms and you will vacation take a trip disrupted typical series.

The guy entitled to the attendees to help you approach these issues that have visibility, speaking out up against discrimination and stereotypes. The new Bethany Class Ceo Carla Beck along with took the new stage so you can admit two the new honorary lifestyle participants, Adeline Quick, a big donor and you can loyal recommend of your business, and you will Hal Strudwick, a loyal voluntary. These two individuals have made a great affect the fresh community with the performs. I’ve achieved over to several small enterprises citizens from our people to aid you bequeath the definition of for the community Dining Drive.

You will have to put at least $5,one hundred thousand for the very first tier and maintain you to definitely average balance inside the next complete 30 days pursuing the account is unsealed. You might heap so it render making use of their checking account bonus to help you earn a total of $850. We difficulty one come across any company checking account offering that sort of APY. Very while you are, sure, the mandatory put number is high, along with the new competitive interest rate, we think this can be a good window of opportunity for businesses to your readily available dollars. Perchance you’lso are ranging from operate, are notice-functioning, otherwise your employer pays your from the look at or in bucks. Speaking of all the appropriate reasons why you may not manage to prepare lead dumps with your financial.

What number of problem banks represented 1.5 % from overall banking institutions, that has been within the typical variety to have non-crisis attacks of 1 to help you dos % of the many banking companies. Complete property kept from the situation financial institutions increased $1 billion in order to $83 billion inside one-fourth. Unrealized loss on the available-for-sale and you may kept-to-readiness bonds rejected $cuatro billion to $513 billion in the 2nd quarter.

Community Trip to the bucks Warehouse

The fresh deduction is additionally limited by twenty five% of one’s AGI out of Israeli supply. You are able to subtract benefits to particular Canadian charitable groups safeguarded less than a tax treaty with Canada. In order to deduct your contribution in order to a good Canadian charity, you must generally have earnings of offer inside Canada. 597, Information about the usa–Canada Income tax Treaty, to own information on how to figure your own deduction. The financing partnership prides in itself to the personal service, each other so you can personal user people and you may organization participants. Moreover it provides economic training info to the their web site, along with those coating financial degree and company tips.

Synchrony Lender Large-Give Bank account

The brand new FDIC continues to screen issues affecting the newest set-aside ratio, in addition to but not restricted to, insured put progress and possible losings due to lender problems and related reserves. The second chart shows the degree of unrealized loss on the kept-to-readiness and you may available-for-product sales bonds portfolios. Complete unrealized losings from $516.5 billion had been $38.9 billion greater than the earlier one-fourth. Higher unrealized losings to your domestic mortgage-backed ties drove the rise, while the financial prices enhanced in the 1st one-fourth, putting down pressure on the prices of these investments. Our very own 2nd chart reveals the brand new report on the changes within the community net income quarter more than quarter.

We like Upgrade for its brief application process – just 5 minutes and just seven procedures. However they render some other items, along with personal loans, not all the online banking institutions have. For example 65% of the savings membership we reviewed, there are no costs to the account. Update rated one of our very own finest picks for its aggressive APY, which you’ll earn for individuals who manage an equilibrium with a minimum of $1,100. A low-desire checking account normally also offers APYs that may perhaps not carry on on the rate of rising cost of living, and so the to purchase energy of your money normally minimizes over the years. At the top of delivering greatest rates, high-give savings accounts usually don’t provides monthly repair costs otherwise lowest harmony conditions.